What is Quantitative Easying (QE) and how does it impact the U.S. Economy

Are you an analyst, investor, advisor or stock trader looking to better understand quantitative easing (QE) and its impact on the U.S. economy? If so, then this blog post is here to help. We’ll discuss what QE is exactly and how it works with the Federal Reserve system of monetary policy in order to steer economic decisions within the United States. Ultimately, we’ll look at some of the positive and negative effects that have been seen from QE during our present climate of low interest rates throughout much of 2020, in addition to discussing possible outlooks for years ahead.

Define Quantitative Easing (QE): What is it and how does it work

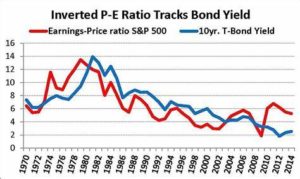

Quantitative Easing (QE) is a monetary policy that governments use to stimulate their economies when traditional methods have failed. Essentially, QE involves the central bank creating new money electronically, which is then used to purchase government bonds and other securities from the market. In doing so, the central bank increases the money supply in circulation, which drives down interest rates and encourages investment and spending. The idea behind QE is that by injecting more money into the economy, businesses will have greater access to the capital they need to expand and hire more workers, while consumers will feel more confident about spending. While QE has been criticized for being a short-term solution to economic problems, it has proven to be an effective way to jumpstart sluggish economies in the past.

History of QE in the US and how it has impacted the economy

Since the financial crisis in 2008, the US Federal Reserve has implemented various rounds of quantitative easing (QE) to stimulate the economy. QE involves the central bank buying large amounts of financial assets, such as government bonds, to increase liquidity and lower interest rates. The first round of QE was implemented in 2008, followed by two additional rounds in 2010 and 2012. While QE has been controversial, with concerns about inflation and the impact on savers, it has also been credited with spurring economic growth and preventing a deeper recession. The impact of QE on the economy is multifaceted, with some arguing that it has widened the wealth gap and increased market volatility. Regardless of differing opinions, the history of QE in the US has been a significant factor in the economy’s recovery and remains a key tool in the Federal Reserve’s arsenal for stabilizing the financial system.

Analyze the potential benefits of QE for businesses, consumers, and investors

Quantitative easing (QE) is a highly-debated monetary policy tool that entails the central bank buying securities to stimulate economic activity. While it can lead to inflation concerns and devalue currencies, QE also has potential benefits for businesses, consumers, and investors. For businesses, QE can lower borrowing costs, allowing for investment in expansion and job creation. Consumers can benefit from increased lending and lower interest rates, which can boost spending and stimulate the economy. Finally, investors can enjoy higher stock prices and increased returns on investment, as companies gain access to easier financing through QE. However, the potential risks of QE cannot be ignored, as it is uncertain whether its benefits will outweigh its drawbacks in the long term.

History of the Federal Reserve Bank in the United States

The Federal Reserve Bank in the United States was founded by an act of Congress in 1913 with the primary purpose of enhancing the stability of the American banking system. It was created to address banking panics, foster a sound banking system, and provide the nation with a safer, more flexible, and more stable monetary and financial system. President Woodrow Wilson signed the Federal Reserve Act into law on December 23, 1913. Before the establishment of the Federal Reserve, the U.S. economy faced frequent episodes of panic, bank failures, and scarce credit. The creation of the Federal Reserve System aimed to serve as a decentralized central bank that balanced the interests of private banks and populist sentiment.

The Federal Reserve System formally committed to maintaining a low interest rate peg on government bonds in 1942 after the United States entered World War II. It has since played a crucial role in U.S. monetary policy and has evolved to become the central bank of the United States. The Federal Reserve System is not “owned” by anyone. It is an agency of the federal government, and the Board of Governors in Washington, D.C., reports to and is directly accountable to Congress. It serves as the U.S. central bank and plays a significant role in managing the nation’s monetary policy.