Rivian Electric Vehicles stock hits high for 2023 on strong demand numbers

Analysts and investors have been eagerly awaiting any news on the performance of Rivian Automotive electric vehicle (EV) sales. The anticipation was rewarded recently with new data showing impressive deliveries that exceeded market estimates, pushing its stock to a 2023 high. It’s clear from this announcement the entire EV sector is primed for growth in 2021 and Rivian is leading the way as one of the most exciting automotive companies to watch right now. Here we analyze what factors drove such incredible numbers and why enthusiasts, advisors, traders, and anyone invested in this team should get ready for an even brighter future ahead.

Overview of Rivian Automotive’s story and milestones leading to its highest stock level in 2023

Rivian Automotive is a company that has redefined the electric vehicle market and has been on an impressive journey since its founding in 2009. The company creates electric adventure vehicles that are designed for the outdoors, and they have been successful in attracting investors who share the same passion for sustainability and environmental preservation. Rivian Automotive has hit significant milestones in its growth, including partnerships with Amazon and Ford, as well as securing funding from several leading investment firms. In 2023, the company reached its highest stock level, a testament to its dedication to innovation, effective leadership, and commitment to bringing its vision of sustainable transportation to life. With its continued success, Rivian Automotive is set to make a significant impact in the automotive industry and shape a sustainable future.

Detailed analysis of why and how the strong customer base drove the demand for their EVs

The success of electric vehicles (EVs) is undeniable, and a significant driver behind it is the loyal customer base that demands high-quality, low-emission vehicles. But what exactly fuels this demand? There are several reasons. Firstly, environmental factors are at play. As consumers become more aware of fossil fuels’ harmful effects on the environment, they seek out greener transportation options. Secondly, strict government regulations on emissions played a part in this shift. Additionally, EVs often require lower maintenance and running costs compared to traditional gasoline vehicles, which makes them more cost-effective for consumers. Finally, technological advancements have made EVs more accessible and user-friendly, leading to an increased adoption rate. In summary, it’s clear that a deeply committed customer base, driven by a combination of economic, environmental, and technological factors, is a leading force pushing the growth of the EV market.

How Rivian Automotive is positioning itself for further success

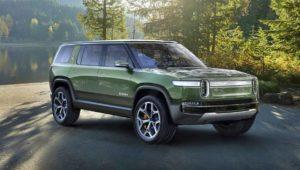

As the automotive industry continues to shift towards electric vehicles, Rivian is positioning itself for further success by expanding its production capacity, rolling out new EV models, and adding more charging infrastructure. The company’s commitment to innovation and sustainability has resonated with consumers who are looking for eco-friendly transportation options without sacrificing performance. With the recent launch of their R1T pickup truck and R1S SUV, Rivian has established itself as a serious player in the EV market. They have also taken steps to build out their charging infrastructure, with plans to install over 10,000 chargers across the US by 2023. These investments in production and infrastructure demonstrate Rivian’s commitment to meeting the growing demand for electric vehicles and position the company for continued success in the years to come.

Implications of the high stock performance on the EV industry

The soaring stock value of electric vehicle (EV) companies is having significant implications for the entire industry and its competitors. With giants such as Tesla experiencing stock growth of over estimated value in one year, it’s clear that the EV market is booming. This presents both opportunities and challenges for competitors. On one hand, it’s clear that there is significant potential for growth and success in this industry. On the other hand, these high valuations make it more difficult for smaller companies to compete. Additionally, with the industry moving at such breakneck speed, it’s essential for competitors to stay ahead of the curve and continue to innovate in order to remain relevant. The growth of the EV market is clearly a positive trend overall, but it’s important for competitors to take stock of the implications and ensure they’re prepared to navigate an ever-changing landscape.

Thinking about investing in Rivian Electric Vehicles stock

Investing in Rivian Electric Vehicles stock can be an exciting opportunity, especially for those interested in sustainable transportation and innovation. However, like any investment, there are a few considerations to keep in mind before jumping in. It’s important to assess the overall market for electric vehicles, as well as Rivian’s specific competitors and growth potential. Additionally, taking a closer look at Rivian’s financials and leadership team can provide insight into the company’s stability and long-term prospects. While there is no guarantee of success in the stock market, doing thorough research and seeking advice from professional financial planners can help investors make informed decisions about investing in Rivian Electric Vehicles stock.

Ultimately, Rivian Automotive success in the EV industry, driven by a strong customer base and strategic expansion plans, is indicative of positive movements across the sector. Investors looking to invest in Rivian Automotive should consider the fundamentals of their business model as well as the broader implications of their stock success as it relates to other competitors in the space. It’s important to note that EV production requires capital investments and so there remain risks associated with investing in any company, regardless of their current stock performance level. However, for those investors looking to make an impact on energy consumption and help accelerate progress toward a more sustainable future – investing in Rivian or other EVs may be an optimal choice. All things considered, it’s clear that for one particular car company, at least, the move away from gasoline has been embraced wholeheartedly by consumers – and rewarded accordingly by dedicated shareholders.