Understanding the Earnings Multiplier: A Key Metric in Investment Analysis

In the world of finance and investing, understanding key metrics is essential for making informed decisions. One such metric that holds significant importance for investors is the earnings multiplier, also known as the price-to-earnings (P/E) ratio. The earnings multiplier provides insight into how the current stock price of a company compares to its earnings per share (EPS), serving as a simplified valuation tool and aiding in investment decision-making.

Calculation and Interpretation

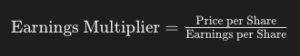

The earnings multiplier is calculated by dividing the market price per share of a company’s stock by its earnings per share. Mathematically, it is expressed as:

For example, if a company’s stock is trading at $50 per share, and its earnings per share is $5, then the earnings multiplier would be 10 ($50 / $5 = 10). This indicates that investors are willing to pay 10 times the company’s earnings to own a share of its stock.

Significance and Utility

The earnings multiplier serves multiple purposes in investment analysis:

- Valuation Comparison: One of the primary uses of the earnings multiplier is to compare the relative valuation of similar companies. By comparing the P/E ratios of different companies within the same industry or sector, investors can gauge which stocks are relatively more expensive or cheaper based on their earnings.

- Historical Analysis: Investors often use the earnings multiplier to assess whether a company’s stock is currently overvalued, undervalued, or fairly valued compared to its historical P/E ratio. Significant deviations from historical averages may indicate potential investment opportunities or risks.

- Market Sentiment: Changes in the earnings multiplier can reflect shifts in investor sentiment towards a company. A rising P/E ratio may suggest optimism about future earnings growth, while a declining ratio may signal concerns or pessimism.

- Benchmarking: The earnings multiplier can also serve as a benchmark for evaluating the performance of an individual stock or portfolio against broader market indices or investment benchmarks.

Limitations and Considerations

While the earnings multiplier is a widely used metric, it has certain limitations and considerations that investors should be aware of:

- Earnings Quality: The accuracy and reliability of earnings per share can vary due to factors such as accounting methods, one-time charges, and non-recurring items. Therefore, it is essential to assess the quality and sustainability of a company’s earnings before relying solely on the P/E ratio for valuation purposes.

- Growth Prospects: A high P/E ratio does not necessarily indicate overvaluation if the company has strong growth prospects that justify the premium. Conversely, a low P/E ratio may not always signify undervaluation if the company’s earnings are expected to decline or stagnate.

- Industry Variations: Different industries may have different typical ranges of P/E ratios due to variations in growth rates, profitability, and risk profiles. Therefore, it is crucial to compare P/E ratios within the context of the industry and sector norms.

- Market Conditions: Market dynamics, investor sentiment, and macroeconomic factors can influence P/E ratios, leading to temporary distortions or anomalies in valuation metrics.

In summary, the earnings multiplier, or price-to-earnings ratio, is a fundamental metric in investment analysis that provides valuable insights into the relative valuation of a company’s stock. By comparing the P/E ratios of similar companies, analyzing historical trends, and considering other relevant factors, investors can make more informed decisions about buying, selling, or holding stocks in their portfolios. However, it is essential to recognize the limitations of this metric and use it in conjunction with other fundamental and technical analysis tools for comprehensive investment evaluation.