Elliot Wave Theory: An In-depth Analysis for Investors

In the dynamic world of finance, where markets can seemingly shift on a whim, investors are constantly seeking tools and methodologies to understand and predict price movements. One such tool that has gained significant traction among technical analysts is the Elliott Wave Theory. Developed by Ralph Nelson Elliott in the early 20th century, this theory has become an essential framework for understanding market trends and identifying potential opportunities for investors. In this comprehensive analysis, we delve into the intricacies of the Elliott Wave Theory, its underlying principles, and why it is crucial for investors to be aware of its implications.

Understanding the Elliott Wave Theory

At its core, the Elliott Wave Theory seeks to explain the behavior of financial markets by identifying recurring patterns in price movements. According to Elliott, market trends unfold in a series of waves, with each wave representing a specific phase in the overall price cycle. These waves are not random fluctuations but rather exhibit a discernible pattern based on human psychology and mass investor behavior.

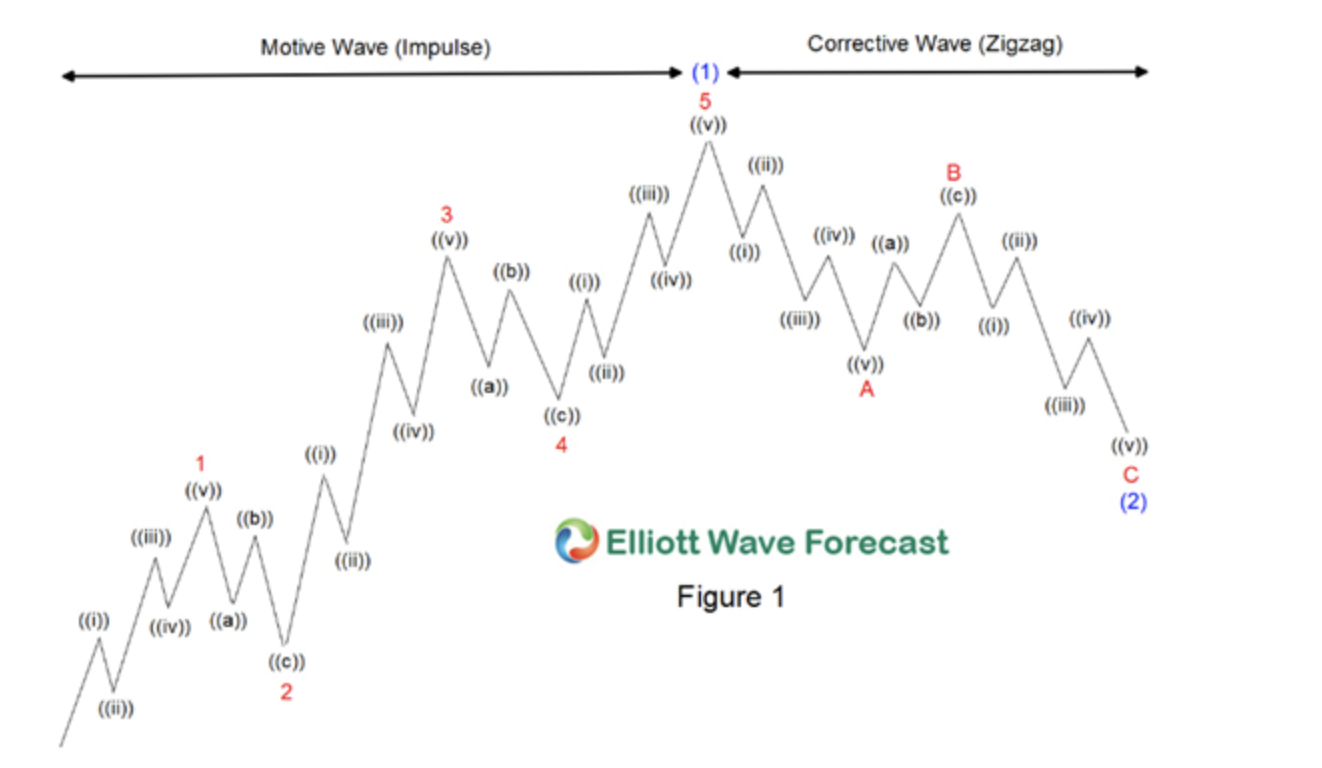

The Elliott Wave Theory is founded on two fundamental principles: impulse waves and corrective waves. Impulse waves represent the primary direction of the trend, while corrective waves denote temporary counter trend movements. These waves are further subdivided into smaller degrees, creating a hierarchical structure of waves within waves. This fractal nature is a defining characteristic of Elliott Wave analysis, allowing analysts to analyze price movements across multiple time frames.

Application in Technical Analysis

One of the key aspects of the Elliott Wave Theory is its applicability in technical analysis. By identifying specific wave patterns, analysts can gain insights into the future direction of prices and anticipate potential turning points in the market. The most common wave patterns recognized in Elliott Wave analysis include:

- Five-Wave Impulse Pattern: This pattern consists of three bullish waves (labeled 1, 3, and 5) separated by two bearish waves (labeled 2 and 4). The bullish waves represent upward momentum, while the bearish waves signify corrective retracements.

- Three-Wave Corrective Pattern: Following the completion of an impulse wave, the market typically undergoes a corrective phase consisting of three waves (labeled A, B, and C). This pattern allows investors to identify potential entry points for trades, as corrective waves often present opportunities for counter trend reversals.

- Extensions and Alternations: In addition to the basic wave patterns, Elliott Wave theory acknowledges the concept of extensions and alternations, which describe variations in wave structure. Extensions occur when one wave within a pattern is significantly longer than expected, indicating heightened momentum in the market. Alternations, on the other hand, refer to differences in the form or duration of related waves, providing further insight into market dynamics.

By applying these principles to historical price data, analysts can construct Elliott Wave counts and develop forecasts for future price movements. This analytical framework serves as a valuable tool for traders and investors seeking to navigate the complexities of the financial markets.

Why Investors Need to Be Aware of Elliott Wave Theory

In the ever-evolving landscape of finance, staying ahead of market trends is essential for investors seeking to maximize returns and mitigate risks. The Elliott Wave Theory offers a systematic approach to understanding market dynamics and identifying potential trading opportunities. By incorporating wave analysis into their investment strategy, investors can:

- Identify Market Trends: Elliott Wave analysis allows investors to discern the primary direction of the market, enabling them to align their investment decisions with prevailing trends. By recognizing the sequence of impulse and corrective waves, investors can determine whether the market is in an uptrend, downtrend, or consolidation phase.

- Anticipate Price Reversals: One of the most significant advantages of Elliott Wave theory is its ability to forecast potential turning points in the market. By identifying wave patterns and recognizing key Fibonacci retracement levels, investors can anticipate where price reversals are likely to occur and adjust their positions accordingly.

- Manage Risk Effectively: Understanding Elliott Wave theory empowers investors to manage risk more effectively by implementing disciplined trading strategies. By setting stop-loss orders and adhering to risk management principles, investors can limit potential losses and preserve capital in volatile market conditions.

- Enhance Trading Performance: Incorporating Elliott Wave analysis into trading strategies can lead to improved performance and consistency over time. By combining wave analysis with other technical indicators such as moving averages and oscillators, investors can make more informed trading decisions and achieve superior risk-adjusted returns.

In conclusion, the Elliott Wave Theory offers a comprehensive framework for understanding market trends and identifying potential trading opportunities. By recognizing the inherent patterns in price movements and applying wave analysis techniques, investors can gain valuable insights into market dynamics and make more informed investment decisions. While Elliott Wave analysis is not without its limitations and challenges, its widespread adoption among technical analysts underscores its relevance and importance in the field of finance. As such, investors would be wise to familiarize themselves with the principles of Elliott Wave theory and consider its implications when formulating their investment strategies.